When it comes to protecting your bike, the best motorcycle insurance strikes the right balance between cost and coverage. In this guide, we’ll compare different coverage types, explain what “full coverage” actually includes, and share smart ways to save without cutting corners.

Whether you're a new rider or a seasoned motorcyclist, you’ll walk away with a clear understanding of how to get the right protection for your bike, your budget, and the way you ride.

What Is Motorcycle Insurance and Why Do You Need It?

Motorcycle insurance protects you from financial risk in an accident, theft, or damage. It covers liability for injuries or damage you cause to others, and depending on your policy, it can also pay for repairs to your bike, medical expenses, and even lost income.

Motorcycle insurance is legally required in most states. In Maryland, for example, you must purchase liability insurance to register your motorcycle and obtain tags.

Beyond legal compliance, motorcycle insurance can protect you from major financial loss. The average motorcycle accident settlement in the U.S. is $66,107.65, with most settlements ranging from $10,000 to $100,000. Without adequate coverage, you’re on the hook for those costs yourself.

Whether financing your bike, riding daily, or just taking weekend trips, motorcycle insurance stands between you and a financial setback that could take years to recover from.

How Does Motorcycle Insurance Work?

Motorcycle insurance works like other types of vehicle coverage: you pay a premium in exchange for protection against specific risks. If something happens—an accident, theft, or damage—you file a claim, and your insurer may cover the cost, minus your deductible.

What Affects Your Rates?

Several factors impact what you pay for coverage:

- Rider age and experience: Newer, younger riders tend to pay more due to higher risk.

- Type of bike: Sportbikes typically cost more to insure than cruisers or scooters because they’re more powerful and more likely to be involved in accidents.

- Location: Urban areas usually mean higher premiums due to increased theft and crash risk.

- Riding habits: How often and how far you ride each year can influence your rate. Less mileage often means lower premiums.

What Does Motorcycle Insurance Cover?

The best motorcycle insurance policies are made up of several types of coverage. While some are legally required, others are optional but highly recommended, especially if you want protection beyond the bare minimum.

Core Coverage Options

1. Liability (Bodily Injury + Property Damage)

Liability coverage pays for injuries or damage you cause to others in an accident. Maryland requires minimum limits of $30,000 per person, $60,000 per accident for bodily injury, and $15,000 for property damage.

2. Collision

Collision coverage covers repairs to your motorcycle if it’s damaged in an accident, regardless of who was at fault. It’s essential if you want to protect your bike’s value after a crash.

3. Comprehensive

This coverage pays for damage not caused by a collision, such as theft, vandalism, fire, or weather-related incidents. It’s especially useful for riders who store their bikes outdoors or ride year-round.

4. Medical Payments

Medical payments coverage helps cover medical bills for you and your passenger after an accident, no matter who was at fault. Even minor accidents can lead to high out-of-pocket costs, making this coverage worth considering.

5. Uninsured/Underinsured Motorist (UM/UIM)

UM/UIM covers your medical expenses and property damage if you're hit by a driver who doesn't have insurance, or doesn't have enough. With around 1 in 7 drivers uninsured, this coverage offers critical protection against being left with the bill after a crash that wasn’t your fault.

What Is Full Coverage Motorcycle Insurance?

“Full coverage” is a common term but often misunderstood. Many riders think it means you’re covered for anything that could go wrong, but that’s not the case.

In reality, full coverage usually refers to a combination of:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Sometimes Uninsured/Underinsured Motorist (UM/UIM) and Medical Payments

It doesn’t cover everything automatically. For example, custom parts, roadside assistance, or total loss replacement typically require additional add-ons.

When Full Coverage Makes Sense

Full coverage is essential if:

- You’re financing or leasing your motorcycle (lenders usually require it).

- You own a newer or high-value bike that you can’t easily replace out of pocket.

- You ride frequently, commute, or travel long distances.

If you want your policy to protect your bike (not just others involved in a crash), full coverage is the way to go. Just keep in mind, it doesn’t cover everything.

Custom parts, towing, and total loss replacement often require policy add-ons. Always review the details to be sure you’re not underinsured in areas that matter most to you.

Types of Motorcycle Insurance: Which Is Right for You?

Not all two-wheeled vehicles are treated the same when it comes to insurance. What you ride, and how you ride it, can affect both your coverage needs and legal requirements.

Bike Insurance vs. Scooter and Motorbike Insurance

Motorcycles typically require full motorcycle insurance, including liability coverage that meets your state’s minimum limits. This applies to cruisers, sportbikes, touring bikes, and most standard models.

Scooters and motorbikes (smaller, less powerful two-wheelers) may qualify for lower-cost insurance, but they still often require liability coverage and registration, depending on engine size.

While scooters may cost less to insure, don’t assume they’re exempt from accidents or theft, especially in urban areas where they’re common targets. E-bikes, on the other hand, are not legally required to be insured in most states, but it’s still a good idea to consider coverage. With their growing popularity and increased risk of theft or collision, having insurance can help protect you financially if something goes wrong.

Policy Add-Ons to Consider

Depending on your bike, riding habits, and level of investment, these optional coverages can add valuable protection:

Covers towing, jump-starts, flat tires, and lockouts. A small add-on that can save you big when you're stranded far from home.

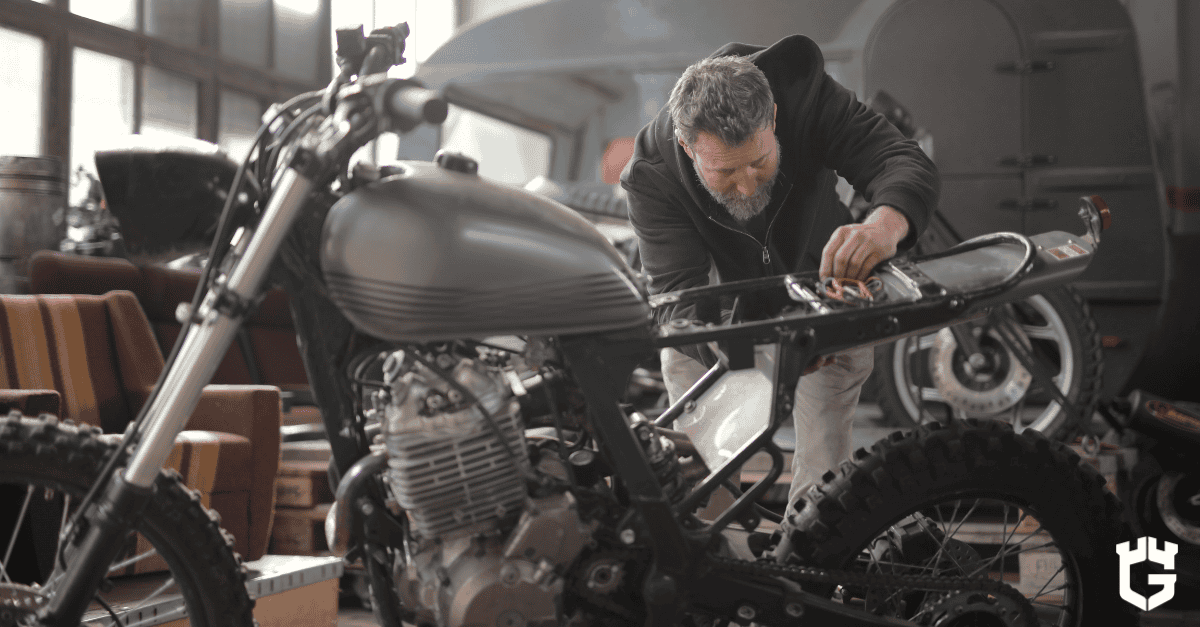

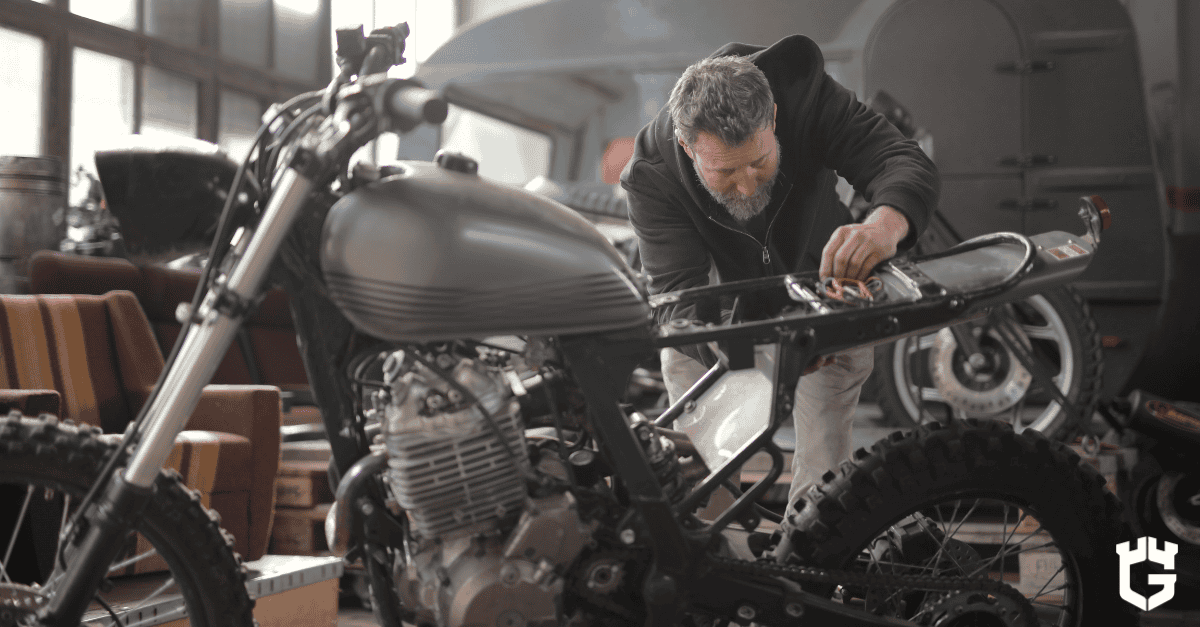

Protects custom parts, helmets, saddlebags, and aftermarket upgrades that aren’t included in standard collision or comprehensive policies.

Covers lodging, meals, and transportation if your bike breaks down far from home. It’s especially useful for touring riders or long-distance trips.

-

Transport Trailer Coverage

Covers damage to your trailer while hauling your motorcycle. Important if you regularly transport your bike rather than ride it to your destination.

Choosing the best motorcycle insurance means understanding your bike, how you use it, and what extra protections make sense. A standard policy may be enough for casual riders, but if your bike is your passion or your primary transportation, customizing your coverage is worth the investment.

How to Get Good Rates Without Sacrificing Coverage

Everyone wants to save money on insurance, but cutting corners can cost you more in the long run. The key is finding the right balance between affordability and protection.

Cheapest Motorcycle Insurance Isn’t Always the Best

Low premiums can be tempting, but they often come with gaps in coverage. Choosing a bare-minimum policy might leave you without collision or comprehensive protection, and in the event of an accident, that can mean thousands in out-of-pocket costs.

Worse, cheap policies may come with poor customer service, slow claims processing, or strict payout limits.

The goal isn’t to pay as little as possible. It’s to pay the right amount for coverage you can count on.

Start by identifying the coverage you truly need based on your bike’s value, how often you ride, and where you ride. Then, you can adjust your deductible and explore discounts without sacrificing key protections.

How to Lower Your Premiums

Here are proven strategies to reduce your motorcycle insurance costs without exposing yourself to risk:

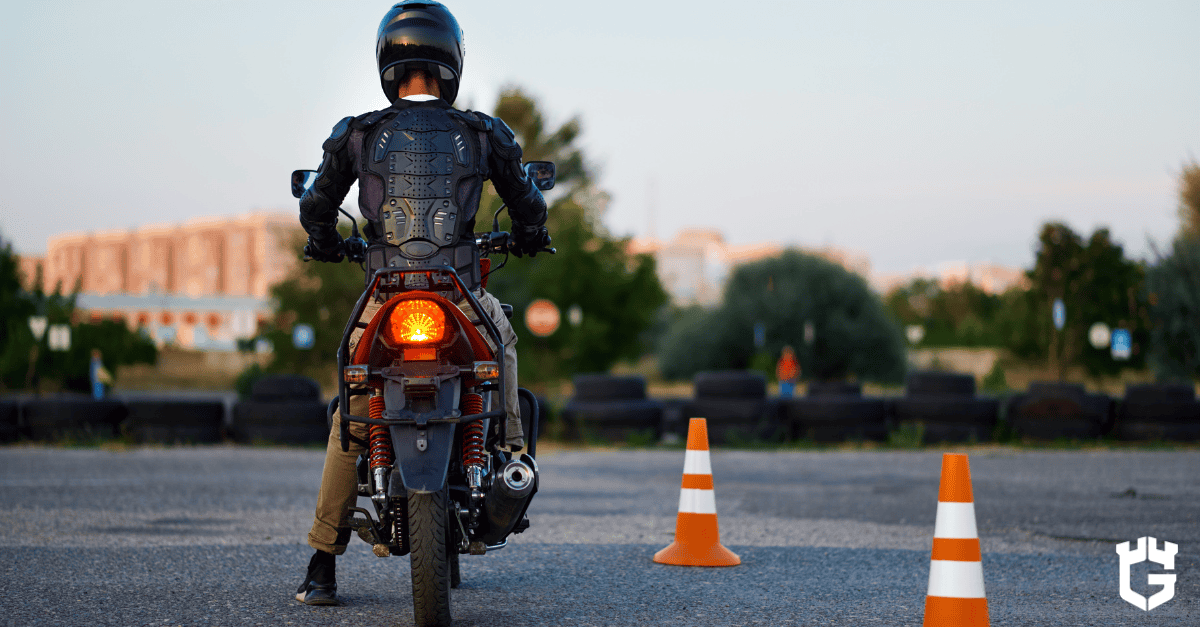

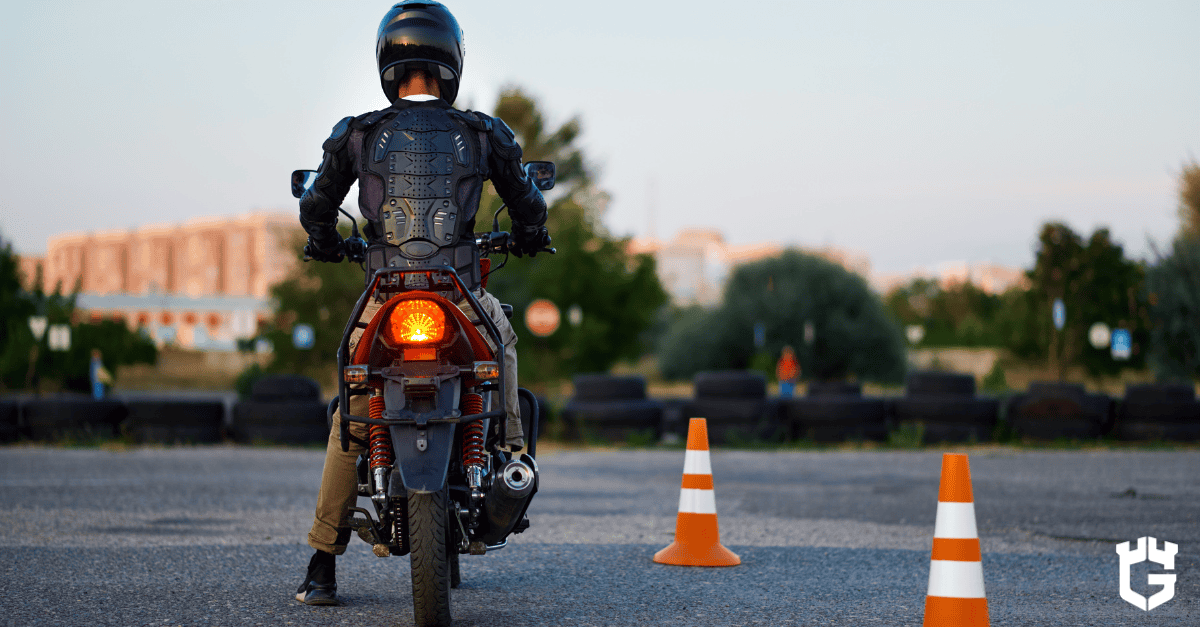

- Complete a Motorcycle Safety Course: Taking an approved safety course can earn you a discount and make you a safer rider.

- Bundle with Home or Auto Insurance: Many providers offer multi-policy discounts when you bundle motorcycle insurance with your auto or homeowners policy.

- Raise Your Deductible Wisely: A higher deductible can lower your premium, but make sure it’s still an amount you can afford to pay out-of-pocket in a claim.

- Maintain a Clean Riding Record: Avoiding accidents and violations lowers your premiums over time.

- Consider Usage-Based or Pay-Per-Mile Insurance: If you only ride occasionally, ask about policies that factor in mileage. These plans can offer big savings for low-mileage riders.

Choosing the Best Motorcycle Insurance for Your Needs

With so many coverage options, providers, and add-ons, the best policy is the one that’s tailored to how you ride. Before you commit, take a step back and assess your needs with a few key questions.

1. What’s my risk level?

Do you ride every day or just on weekends? City streets or rural roads? The more often and the more unpredictable your riding conditions, the more protection you’ll likely need.

2. Do I need seasonal coverage adjustments?

If you store your bike for part of the year, some insurers offer lay-up policies that pause certain coverages while still protecting against theft or fire.

3. Am I covering custom parts or upgrades?

Aftermarket parts, accessories, and custom work often aren’t included in standard policies. If you’ve invested in your bike, make sure your coverage reflects it.

When to Review and Update Your Policy

Even if you’re happy with your current policy, circumstances change. Be sure to revisit your coverage:

- After buying a new bike – Higher value often means new coverage needs.

- After moving or changing how you ride – Location and mileage both affect your premium.

- At least once a year – Compare quotes, check for new discounts, and make sure your policy still fits.

Talk to a Local Motorcycle Insurance Expert

When it comes to protecting your bike, there’s no substitute for local expertise. At Gerety Insurance, we’re a Maryland-based agency that understands local riders' needs. We tailor coverage to fit how and where you ride.

Working with a local agent means getting straight answers, fast support, and coverage that makes sense for your bike and your budget. We’re here to help you get the protection you need with the personal service you deserve.