It’s very tempting to buy insurance online. It seems quick, easy, and convenient.

But is it really the best choice for protecting what matters most to you? At Gerety Insurance, we want to make sure you have all the information and understand the risks before clicking “buy” on that digital insurance platform.

Are Online Insurance Quotes Accurate?

Online insurance quotes often fail to provide a complete picture of your coverage needs. Here’s why these quotes might not be as accurate as you’d hope:

One-size-fits-all doesn’t fit anyone.

Many online platforms specialize in specific types of insurance, like car or renter’s insurance. This narrow focus can lead to quotes that don’t accurately reflect your total insurance needs.

If you require multiple types of coverage, you might end up with several policies across different platforms. This increases complexity and raises the risk of oversight, potentially resulting in inaccurate overall cost estimates and coverage assessments.

Gaps in coverage could leave you exposed.

Digital platforms often rely on automated recommendations that overlook your unique circumstances, leading to less accurate quotes.

Without an agent’s expert guidance, online quotes may miss essential coverage or fail to account for gaps between separate policies. You can end up with quotes that seem accurate but don’t reflect your comprehensive insurance needs.

At Gerety, we review all your policies together, ensuring your quote accurately represents complete protection.

Algorithms can’t understand your unique situation.

Digital insurers frequently use algorithms for underwriting and claims assessments when generating quotes. While efficient, these algorithms can sometimes lead to biased or unfair treatment, resulting in quotes that don’t reflect your true risk profile or coverage needs.

An agent’s personalized approach helps mitigate these risks by holistically considering your circumstances. This human touch can lead to more accurate quotes that truly account for your insurance requirements and risk factors.

Is Online Insurance Safe?

While convenience is appealing, online insurance platforms are at an increased risk of data breaches because they contain a treasure trove of sensitive information.

They store everything from social security numbers to banking details, making them prime targets for cybercriminals. Each additional online platform you use increases your exposure to potential data breaches.

Digital insurers rely heavily on their tech infrastructure. But what happens when that technology fails?

System outages or cyberattacks can disrupt services, potentially affecting your coverage or claims process at critical moments.

Your local insurance agent, on the other hand, provides a human touchpoint that isn’t dependent on a single technological system. When digital platforms falter, your agent is still there to provide continuity and direct assistance.

Even the most sophisticated online platforms are susceptible to human error.

Mistakes in coding, data entry, or system updates can lead to incorrect policy information, pricing errors, or claim processing issues.

These errors might go unnoticed in an automated system until they cause significant problems. In contrast, a local agent provides additional oversight, catching and correcting potential errors before they impact your coverage or claims.

When you choose a local insurance agent over an online platform, you’re not just buying a policy—you’re investing in a relationship with someone who prioritizes your privacy, security, and peace of mind.

Why Buying Insurance from a Local Agent is the Best Choice

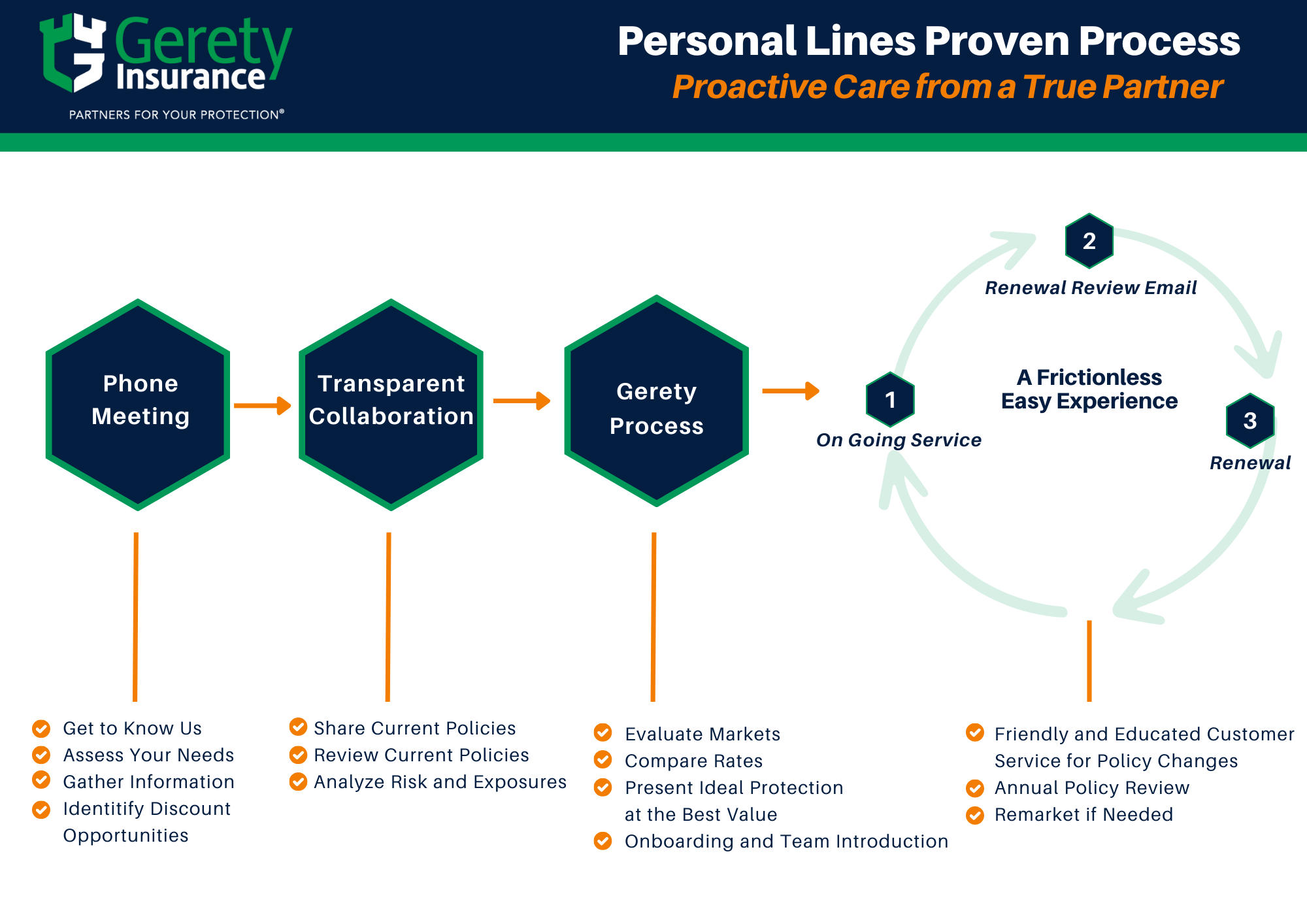

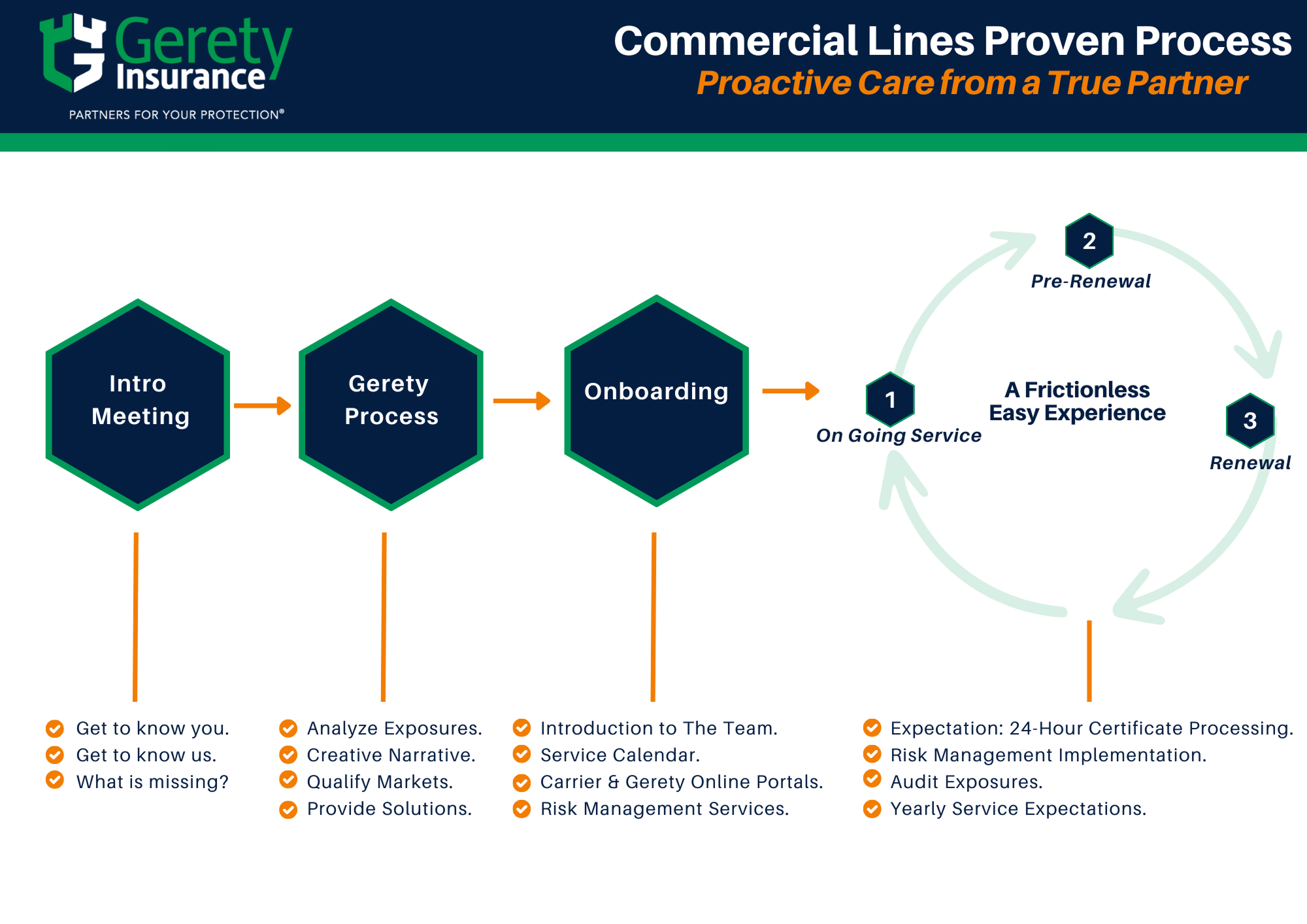

At Gerety Insurance, we believe that personal relationships and local expertise make all the difference in providing the best insurance coverage for our community. Here’s why we think choosing a local agent is your best option:

1. Local agents provide personalized assistance that digital insurance platforms simply can’t match.

We’ve found that our clients particularly value this when dealing with complex claims or unique insurance needs.

Whether you’re a homeowner with multiple properties, a business owner with specific liability concerns, or an individual with unique insurance requirements, a local agent can guide you through every step of the process.

2. Working with a local insurance agent means getting real people and real answers.

When you have questions about your policy, you shouldn’t have to wait for an automated response or search through FAQs.

With a local agent, you can speak directly to a knowledgeable professional who know your policy inside and out. You get immediate, accurate answers to your questions and always understand your coverage.

3. We enhance our services with technology, but we’re not dependent on it.

Unlike online platforms where policy access and updates rely entirely on apps or websites, local agents ensure continuity of support regardless of technological changes or glitches.

At Gerety, for instance, you can reach us by phone, email, or in person at our local office—whichever is most convenient for you.

4. With a local agent, you’re never just a case number.

Great local insurance agents go beyond streamlined submissions—we advocate for you throughout the entire claims process.

We work to ensure your claim is properly addressed, fight for fair resolutions, and provide the personal attention that automated systems lack.

5. Local agents understand the specific insurance needs and challenges residents and businesses face.

In our experience, this knowledge has allowed us to provide more relevant, targeted insurance solutions than any one-size-fits-all online platform. Being neighbors committed to protecting our community makes a real difference in how we work.

When you choose a local agent, you’re not just buying a policy; you’re partnering with a team of local experts dedicated to your security and peace of mind.

Local Agents Who Put People Before Policies

When it comes to protecting what matters most, don’t risk your peace of mind on impersonal algorithms and faceless online platforms. Your family, your home, your business—they deserve the personalized care and expert guidance that a local agent can provide.

At Gerety Insurance, we’re committed to your security and dedicated to explaining your coverage in terms you can understand. We’re an advocate who will be there for you, fighting for fair resolutions when you need to file a claim.

Ready to experience the difference a local agent can make? Request a quote today.