Understanding car insurance terminology can feel maddening and overwhelming.

But having this knowledge is the key to making empowered decisions about your coverage.

We aim to break down complex insurance terms into understandable language, whether you’re…

- Reviewing your policy

- Shopping for new coverage

- Or seeking to better understand the protections you have in place

A clear understanding of these terms can significantly impact your ability to choose the right coverage for your needs.

Let’s make sure you’re well-informed and well-prepared.

Table of Contents:

- Car Insurance Policies

- Claims & Adjustments

- Types of Car Insurance Coverage

- Car Insurance Cost

- Car Insurance Add-Ons

- Car Insurance Liability

- Special Circumstances

- Closing

Understanding Car Insurance Policies

The following terms lay the groundwork for understanding your coverage and its scope.

Declarations Page

Also referred to as an auto insurance coverage summary, an insurance company provides this document.

It lists the following:

- Drivers covered under policy

- Categories of car insurance coverage

- Specific limits for each coverage

- The cost of policy protection

- Specific vehicles covered by the policy

- Types of coverage for each vehicle covered by the policy

Think of it as your policy’s front page, offering a snapshot of your protection.

Policy Holder Meaning

Essentially, this is you—the person who owns the policy and the primary beneficiary of the policy’s protection.

It’s also referred to as the named insured.

This designation determines who is covered in the event of a loss and who bears the rights and responsibilities under the policy terms.

Navigating Claims & Adjustments

Understanding this car insurance terminology will keep you informed when you have to file a claim or deal with policy adjustments.

Covered Loss

Not all incidents will fall under your policy.

A covered loss defines the specific incidents or damages your policy will cover.

It’s the foundation of your claim, outlining the boundaries of your insurance’s responsibility.

Claims Adjuster

This is the person who evaluates the claim after you report a loss.

The claims adjuster investigates the incident, assesses the damage, and determines the insurer’s liability.

Accident Report Form

Sometimes called a police report, this form contains important information about an auto accident.

It can detail circumstances that led to the accident, the parties involved, and information regarding any citations given.

Types of Car Insurance Coverage

Next, you need to familiarize yourself with different types of car insurance coverage.

Understanding this car insurance terminology will help you choose the right protection for your

vehicle and yourself.

Each type serves a unique purpose, safeguarding against different risks associated with owning and operating a vehicle.

-

Automobile Liability Insurance

This type of insurance is fundamental and a legal requirement in many areas.

It provides coverage when the policy holder causes an accident and physical or property damage occurs to another party.

-

Bodily Injury Liability Coverage

Bodily injury coverage is a crucial component of auto insurance that provides financial protection in the event that you injure someone else in a car accident. This coverage helps pay for medical expenses, rehabilitation costs, and even legal fees if you’re sued for causing injuries to another person. It also extends to cover passengers in your vehicle who may sustain injuries during an accident.

This coverage kicks in if an insured person is legally liable for an accident and provides coverage for defense costs if the insured is sued.

Having adequate bodily injury coverage is essential for safeguarding both yourself and others on the road.

-

Collision Coverage

Collision coverage is a vital aspect of auto insurance that provides protection in the event of a collision with another vehicle or object. This coverage assists in covering the costs of repairing or replacing your vehicle, regardless of who is at fault for the accident.

While collision coverage isn’t required by law, it’s often recommended, especially if you have a newer or more valuable vehicle.

-

Comprehensive Coverage

This type of coverage steps in for non-collision incidents, offering a safety net against various other risks:

- Fires

- Thefts

- Windstorms

- Floods

- Vandalism

-

Medical Payments Coverage

This coverage pays for reasonable medical expenses and death benefits to the policy holders and passengers injured in accidents, regardless of fault.

It’s crucial in helping to pay for immediate healthcare needs.

-

Personal Injury Protection Coverage (PIP)

This coverage pays for medical expenses. In some states, it will also pay for lost wages and other damages when someone is injured in an accident, regardless of who is at fault.

It often covers pedestrians struck by vehicles as well.

-

Property Damage Liability Coverage (PD)

PD coverage addresses damage to other people’s property if the insured is found at fault for an accident.

It covers the cost of repairs or replacement for damage. This coverage also pays for legal defense expenses if you are sued.

Each type of car insurance coverage addresses specific scenarios and policy holder needs.

Finding the right coverage helps you navigate the roads confidently, knowing you’re financially protected against a wide range of potential accidents.

Understanding Car Insurance Cost

Cost is a critical component of any insurance policy. The following terms will help you understand your car insurance costs:

-

Premium

Your premium is the price you pay for your insurance coverage.

Various factors like your driving history, vehicle type, and coverage amounts determine it.

Garaging location—where you park your car—can also impact your insurance premiums.

This factor considers the risks associated with the area where the vehicle is kept, such as theft, vandalism, and accident rates.

A higher-risk garaging location can lead to higher premiums.

You must regularly pay your premium to keep your policy active and maintain coverage.

-

Deductible

The deductible plays a significant role in insurance claims.

It’s the amount you agree to pay out-of-pocket before your insurance coverage kicks in to cover the rest of the costs.

Deductibles directly affect your policy’s out-of-pocket costs, with higher deductibles typically leading to lower premiums.

-

Primary Use

Primary use refers to how a policy holder mainly uses their vehicle, with options often including:

- Work

- Business

- Pleasure

- Farm use

Primary use helps insurers assess the risk level and can influence premium calculations.

-

Limits

The limit is the maximum dollar amount of protection purchased by the policy holder for specific coverages.

In some states, legal requirements mandate a minimum amount of coverage to ensure a baseline of financial protection in the event of an accident.

These terms can help you understand insurance costs and choose a policy that fits your needs and budget.

Enhancing Policies with Car Insurance Add-Ons

Enhancing Policies with Car Insurance Add-Ons

Customizing your car insurance policy with add-ons can significantly enhance your coverage, providing extra protection and peace of mind.

An endorsement is a modification to your existing insurance policy, allowing you to add, remove, or alter coverage. Common endorsements include coverage for:

- Roadside assistance

- Glass repair without a deductible

These modifications enable policy holders to tailor their coverage to meet specific needs.

Rental reimbursement coverage is another add-on that benefits policy holders whose vehicles are undergoing repairs due to a covered loss.

It covers the cost of a rental car, helping you stay mobile without out-of-pocket expenses for transportation during your vehicle’s repair period.

Incorporating add-ons into your policy can provide targeted protections that address your unique concerns, making your car insurance work harder for you.

Protect Yourself and Others—Understand Car Insurance Liability

When a driver is determined to be at fault in an accident, their liability insurance is primarily responsible for covering the damages and injuries caused to the other party.

Understanding fault is essential for navigating the claims process and ensuring that coverage is appropriately applied based on the circumstances of the accident.

Investigations determine fault in auto accidents, which may involve police reports, witness statements, and evidence from the scene.

Insurance companies also conduct their investigations through claims adjusters who review the accident details to assign fault.

The process aims to fairly assess responsibility based on the facts and relevant laws.

It protects the at-fault driver from out-of-pocket expenses for the other party’s losses, guaranteeing financial responsibility is met according to legal requirements.

Coverage for You and Your Passengers

Ensuring the safety and financial protection of you and your passengers is crucial. We’ve looked at some types of car insurance coverage designed for this purpose.

For instance, Medical Payments Coverage guarantees that you and your passengers can receive immediate medical attention without waiting for fault determinations.

Personal Injury Protection Coverage (PIP) can include coverage for medical expenses and lost wages regardless of fault.

These coverages give you and your passengers essential financial protection and peace of mind.

Car Insurance Terminology for Special Circumstances

In the mad world of car insurance terminology, certain situations require specialized understanding and coverage—like when driving a car you don’t own or facing risks from uninsured or underinsured motorists.

Knowing the right car insurance terminology and coverage options in these scenarios can help you protect yourself.

Non-Owners Policy

This coverage is crucial for individuals who drive but don’t own a vehicle.

It provides liability coverage for damages or injuries caused by the driver while operating a vehicle they don’t own.

It’s essential for those who frequently rent cars or drive borrowed vehicles.

Uninsured/Underinsured Motorist Coverage (UM)

UM coverage is vital for protecting yourself against drivers who lack sufficient insurance or have none at all.

In the event of an accident with such a driver, UM coverage helps pay for medical bills, pain, and suffering related to bodily injuries.

It safeguards you from financial losses.

Understanding Your Driving Record

Your driving record plays a significant role in determining your car insurance rates and coverage options.

These terms are key factors related to your driving record:

-

Motor Vehicle Report (MVR)

Your MVR provides a history of your driving, including violations and accidents.

It’s a crucial factor insurers use to assess risk, influencing your insurance premiums and the availability of coverage.

-

Principal Driver

The principal driver is the person who drives the insured vehicle most frequently.

This designation affects policy rates because it reflects the driving habits most likely to impact the vehicle’s risk profile.

-

Vehicle Identification Number (VIN)

The VIN is a unique, 17-character code for identifying vehicles.

Insurance companies use it during the application and claims processes to verify the vehicle’s make, model, year, and features, which can affect insurance costs.

Partners for Your Protection

Understanding car insurance terminology is the foundation for making informed decisions about your coverage.

This knowledge can empower you to confidently navigate the intricacies of car insurance.

Take the time to review your current policy and consider how the terms and coverages discussed apply to your situation.

It’s an excellent opportunity to reassess your needs and guarantee your coverage aligns with your lifestyle and risks.

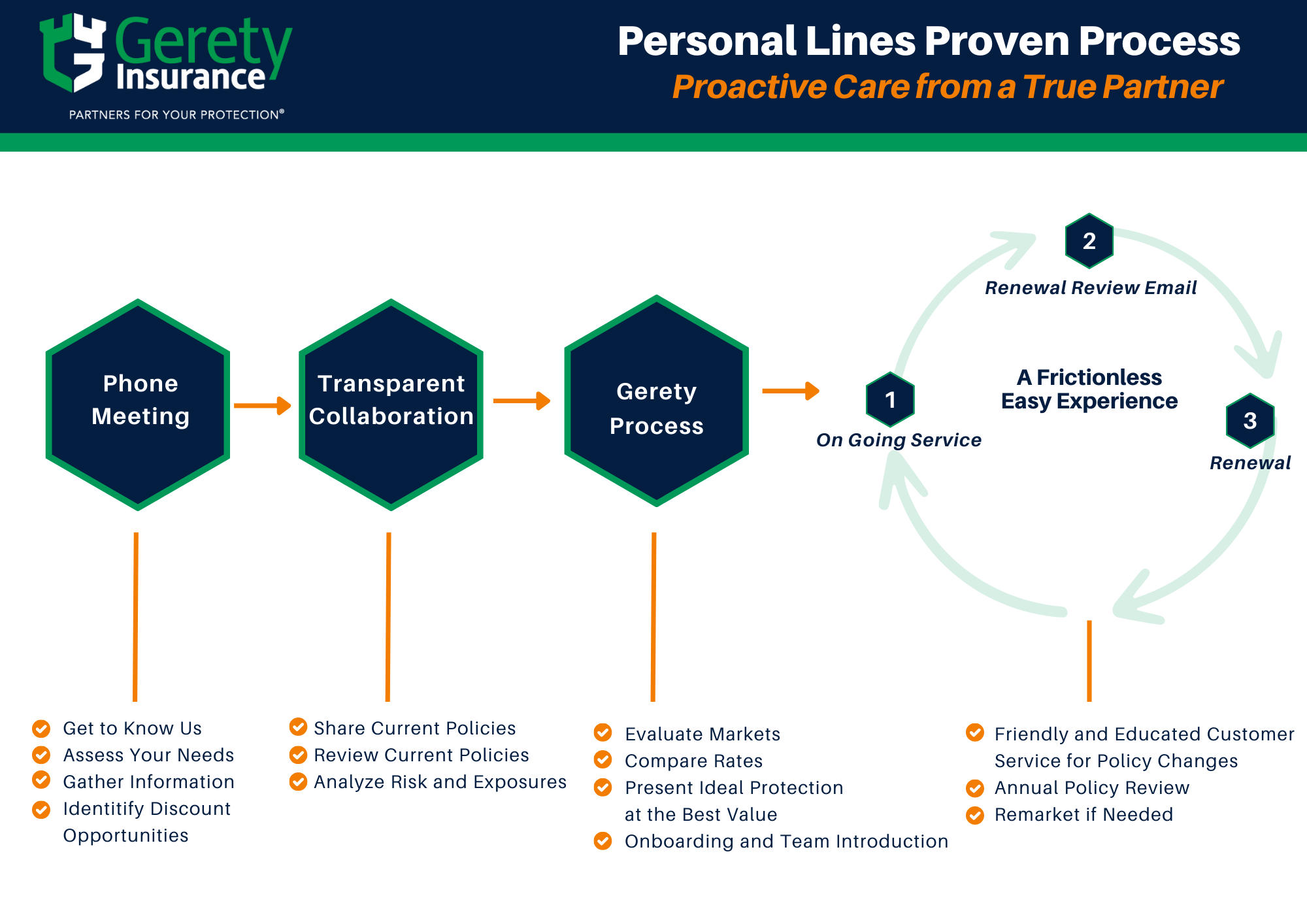

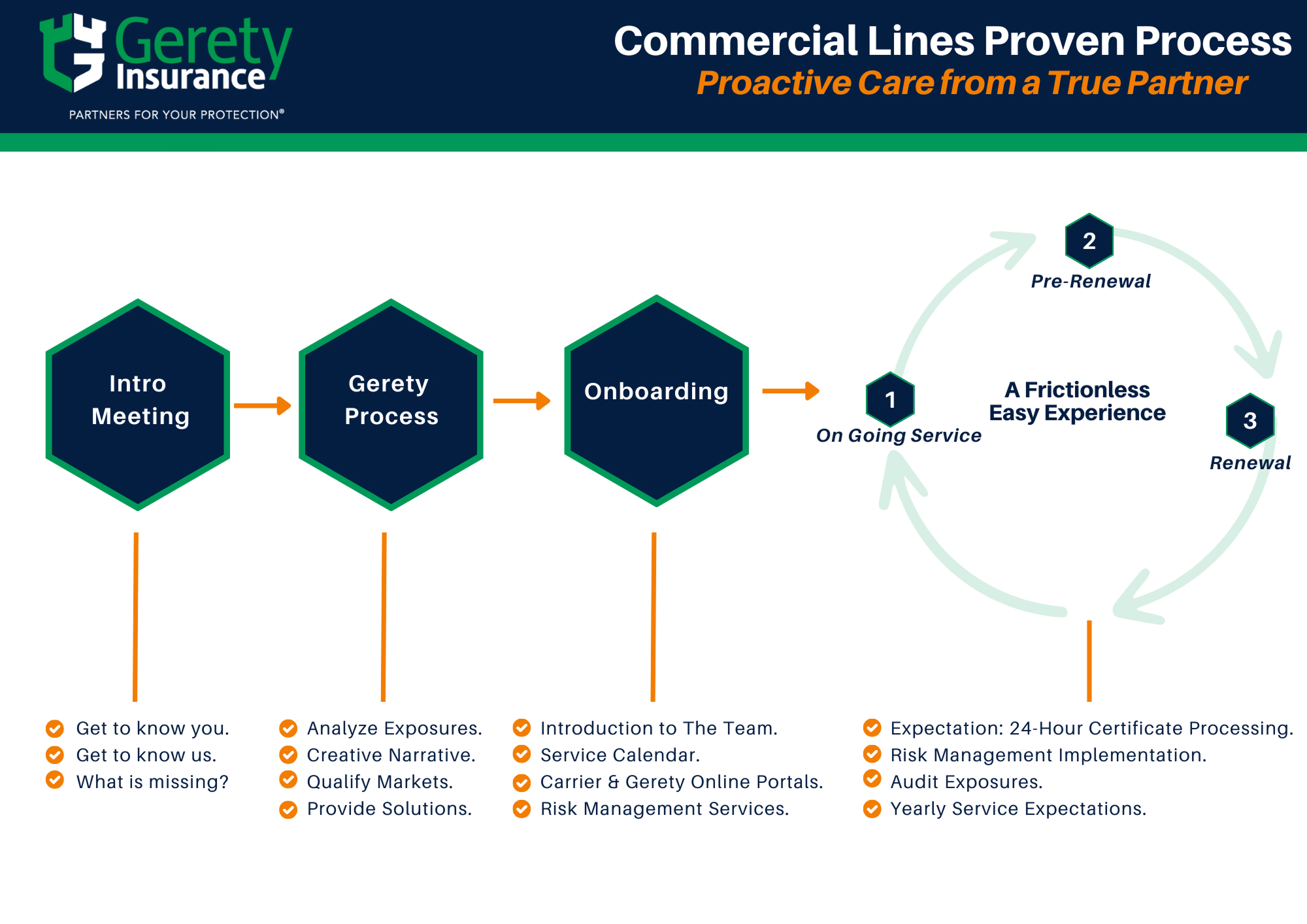

If you’re looking for more personalized advice, Gerety Insurance is here to help.

Our goal is to make car insurance terminology accessible and understandable for policy holders.

Request a quote today—we’re here to guide you through your options and get you the protection you need and deserve.